Smart Money Moves are essential in a world where economic conditions can shift overnight. Whether the market is booming, stagnating, or going through a recession, the right financial habits can help you not only survive but thrive. Building wealth isn’t about quick wins or luck—it’s about consistent, well-planned strategies that protect your assets, increase your income, and grow your investments over time.

This guide will walk you through key wealth-building principles that work in any economy, from saving smartly to leveraging investments, along with a detailed FAQ section to answer common questions.

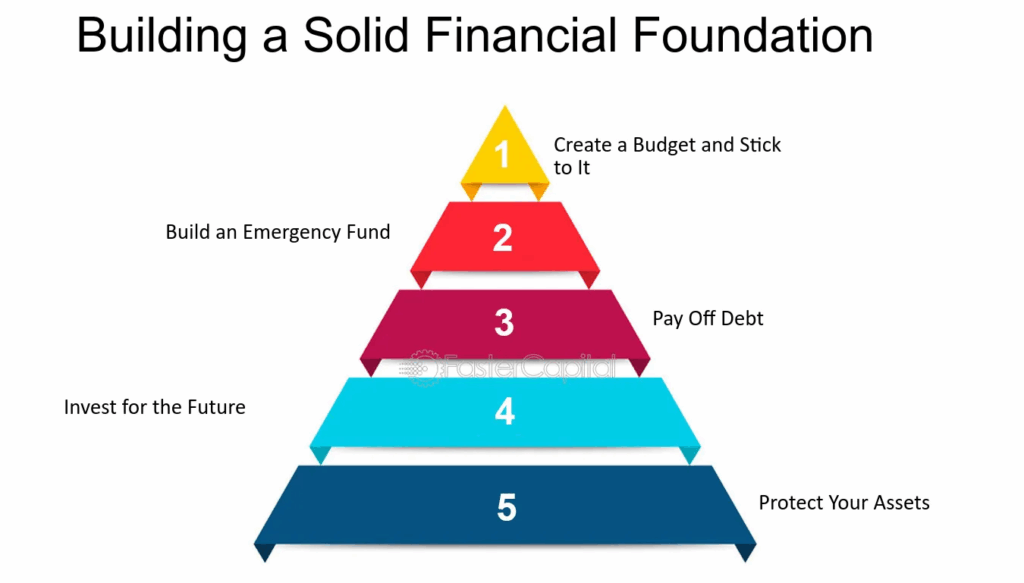

1. Build a Strong Financial Foundation

Before chasing big investment returns, you need to secure your basics.

- Create an emergency fund: Keep at least 6 months of living expenses in a safe, easily accessible account.

- Get out of high-interest debt: Pay off credit cards and personal loans quickly; these are wealth killers.

- Track your expenses: Use budgeting tools to see exactly where your money goes and cut unnecessary costs.

A solid foundation keeps you financially stable when the economy is uncertain.

2. Diversify Your Income Streams

Relying on one income source is risky. To build lasting wealth, develop multiple income streams:

- Side hustles: Freelancing, consulting, or gig work.

- Passive income: Rental properties, dividend stocks, royalties, or online products.

- Investments: Stock market, bonds, index funds, or mutual funds.

By diversifying, you’re less vulnerable to economic downturns.

3. Invest Consistently, Regardless of Market Conditions

Many people try to “time the market” and end up losing out. Instead:

- Use dollar-cost averaging: Invest a fixed amount regularly, whether the market is up or down.

- Focus on long-term growth: Avoid panic selling during downturns.

- Choose assets wisely: Balance between stocks, bonds, and alternative investments based on your risk tolerance.

Even in a recession, consistent investing builds wealth over the years thanks to compounding.

4. Keep Learning About Money

The more financial knowledge you have, the better decisions you’ll make.

- Read books like The Intelligent Investor or Rich Dad Poor Dad.

- Follow reputable finance podcasts, YouTube channels, and blogs.

- Take online courses on investing, budgeting, and real estate.

Financial literacy is the ultimate wealth-building tool.

5. Cut Lifestyle Inflation

As income rises, many people spend more—this is called lifestyle inflation. It kills wealth growth.

- Keep living below your means even as you earn more.

- Save or invest extra income instead of upgrading cars or houses too soon.

- Focus on long-term satisfaction, not short-term luxury splurges.

6. Use Tax-Efficient Strategies

Taxes can eat a big chunk of your wealth. Smart strategies include:

- Max out retirement accounts: 401(k), IRA, or similar tax-advantaged plans.

- Invest in index funds or ETFs: They usually have lower tax implications.

- Track deductible expenses: Especially if you own a business or work freelance.

7. Protect Your Wealth

It’s not just about making money—it’s about keeping it.

- Get insurance: Health, life, and property insurance protect against unexpected losses.

- Have an estate plan: A will and proper asset distribution plan avoid legal battles.

- Stay vigilant: Monitor your accounts for fraud or identity theft.

8. Build Relationships with Financial Experts

Networking with financial advisors, accountants, and investors can open doors to opportunities and knowledge you might not find on your own.

9. Stay Flexible in Changing Economies

Economic conditions shift—sometimes fast.

- In booms: invest aggressively, but don’t over-leverage.

- In recessions: focus on cash flow, avoid unnecessary debt, and hunt for undervalued assets.

Wealth builders adapt instead of resisting change.

10. Think Long-Term

The wealthiest people in the world didn’t get rich overnight. They had patience, discipline, and the ability to stay focused on the big picture. The power of compounding works best for those who start early and stay consistent.

Also Read: Personal Finance – Personal Finance Mastery Helps You Control Spending And Grow Wealth

Conclusion:

In any economy, wealth grows through discipline, smart investing, and adaptability. Stay consistent, protect your assets, and focus on long-term goals to achieve lasting financial independence and security.

FAQs on Building Wealth

Q1: How much should I save before investing?

A: Ideally, build a 6-month emergency fund before putting money into higher-risk investments.

Q2: Can I build wealth without a high income?

A: Yes. The key is living below your means, saving consistently, and investing wisely over time.

Q3: Is real estate better than stocks?

A: Both can build wealth. Stocks are more liquid, while real estate can provide steady cash flow and appreciation.

Q4: Should I pay off debt or invest first?

A: If you have high-interest debt, pay it off before investing heavily—interest can outweigh investment gains.

Q5: How do I start investing with little money?

A: Use micro-investing apps, start with ETFs or index funds, and increase contributions as your income grows.

Q6: What’s the safest investment in a recession?

A: Bonds, gold, and cash-equivalent assets tend to perform better during downturns.

Q7: How can I increase my income quickly?

A: Upskill in high-demand areas, start a side hustle, or take on freelance work.

Q8: What percentage of my income should I invest?

A: Many experts recommend at least 15–20% of your income for long-term investing.

Q9: Is cryptocurrency a good wealth-building tool?

A: It can be, but it’s highly volatile. Invest only what you can afford to lose.

Q10: How do I protect wealth from inflation?

A: Invest in assets like real estate, stocks, and commodities that typically outpace inflation.