Car insurance made simple — these are the words every driver wants to hear. For many people, insurance policies are filled with confusing terms, endless clauses, and complicated payment plans. But it doesn’t have to be that way. With the right approach, you can understand your policy, avoid unnecessary costs, and ensure you’re fully covered when you need it most. Whether you’re buying your first policy, renewing your current one, or switching providers, knowing what matters can save you time, money, and stress.

This guide will walk you through the essentials of car insurance, how to find the best deals, and how to get coverage that truly works for your lifestyle and budget.

Understanding the Basics of Car Insurance

Car insurance is more than just a legal requirement — it’s financial protection against unexpected events like accidents, theft, and damage. At its core, a car insurance policy is a contract between you and your insurance provider. You pay a monthly or annual premium, and in return, the insurer promises to cover certain costs if something happens to your vehicle or if you cause damage to others.

H3: Why You Need Car Insurance

- Legal requirement – Most countries require a minimum level of coverage to drive legally.

- Financial protection – It helps cover costly repairs or medical bills after an accident.

- Peace of mind – You can drive knowing you’re protected against unexpected risks.

Types of Car Insurance Coverage

Before choosing a policy, you should know the main types of coverage available.

Liability Coverage

This covers damage you cause to other people or their property. It doesn’t cover your own vehicle but is often the minimum legal requirement.

Collision Coverage

Pays for repairs or replacement of your vehicle after an accident, regardless of fault.

Comprehensive Coverage

Covers non-collision incidents such as theft, fire, natural disasters, or vandalism.

Personal Injury Protection (PIP)

Helps pay for medical expenses for you and your passengers, regardless of fault.

Uninsured/Underinsured Motorist Coverage

Protects you if you’re in an accident caused by someone without adequate insurance.

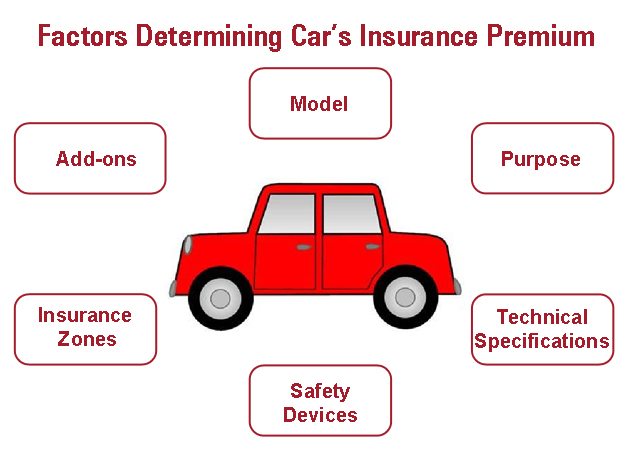

Factors That Affect Car Insurance Rates

Insurance premiums aren’t random — they’re calculated based on various risk factors.

Your Driving Record

A clean driving record usually means lower rates, while accidents or traffic violations can raise premiums.

Vehicle Type

Luxury or sports cars often cost more to insure than standard sedans or SUVs.

Location

Urban areas with high traffic and theft rates usually have higher insurance costs.

Age and Experience

Younger and inexperienced drivers typically pay more due to higher risk profiles.

Coverage Level

The more protection you choose, the higher the premium — but also the better the financial safety net.

How to Save Money on Car Insurance

Saving on car insurance doesn’t mean sacrificing coverage. Here’s how to keep costs low without putting yourself at risk.

Compare Multiple Quotes

Always shop around. Prices can vary greatly between insurers for the same coverage.

Increase Your Deductible

A higher deductible can lower your premium, but make sure you can afford it if an accident happens.

Bundle Policies

Many insurers offer discounts if you combine your car insurance with home or renters’ insurance.

Maintain a Good Credit Score

Some insurers use credit history to set rates, so good credit can mean lower premiums.

Take Advantage of Discounts

Look for discounts for safe driving, low mileage, being a good student, or having certain safety features in your vehicle.

Common Mistakes to Avoid When Choosing a Policy

Even experienced drivers can make costly insurance mistakes.

Choosing the Cheapest Option

The lowest price isn’t always the best value. Make sure the coverage meets your needs.

Not Reading the Fine Print

Always review what’s covered — and what’s excluded — before signing.

Ignoring Deductibles

Low premiums might come with very high deductibles, meaning you’ll pay more out-of-pocket after an accident.

Understanding Policy Terms and Conditions

Insurance policies can be filled with technical jargon. Here are a few terms to know:

- Premium – The amount you pay for insurance coverage.

- Deductible – The amount you pay out-of-pocket before insurance kicks in.

- Claim – A request for your insurer to cover a loss.

- Exclusion – Situations not covered by your policy.

Steps to Get the Best Car Insurance Coverage

- Assess Your Needs – Consider your driving habits, budget, and risk factors.

- Research Providers – Look for those with good customer service and financial stability.

- Request Multiple Quotes – Compare similar coverage from at least three insurers.

- Review the Policy Details – Understand coverage limits and exclusions.

- Make Adjustments Over Time – Review your policy annually to make sure it still fits your needs.

The Role of Technology in Car Insurance

Modern technology has made insurance shopping easier than ever.

Online Comparison Tools

Quickly compare multiple policies side by side.

Usage-Based Insurance

Track your driving habits through a mobile app to potentially earn discounts.

Digital Claims Processing

Submit claims online for faster response and payment.

Final Tips for Choosing Car Insurance

- Avoid overpaying for unnecessary extras.

- Keep your driving record clean.

- Reassess your coverage after major life events, like moving or buying a new car.

Also Read: Business Insurance Made Simple: Protect Your Company From Costly Risks

Conclusion

Car insurance made simple isn’t just about understanding the basics — it’s about making smart choices that protect both your finances and your peace of mind. By knowing the different coverage types, comparing quotes, and avoiding common mistakes, you can get the best deal without compromising protection. Remember, the right policy isn’t just the cheapest one — it’s the one that offers the most value for your specific needs. With the tips in this guide, you’ll be ready to hit the road with confidence, knowing you’re fully covered.

FAQs

Q1: How often should I compare car insurance quotes?

At least once a year or when your circumstances change.

Q2: Can I switch insurance providers anytime?

Yes, but check for cancellation fees or refund policies.

Q3: What’s the difference between comprehensive and collision coverage?

Collision covers accident-related damage to your car, while comprehensive covers non-accident events like theft or natural disasters.

Q4: Will my insurance cover a rental car?

It depends on your policy. Some include rental coverage, while others require it as an add-on.

Q5: Do older cars need full coverage?

Not always — for older vehicles, liability-only coverage may be more cost-effective.